How to find option trades

Find a stock with an upcoming event

See if the options (on a date near the event) has a) HIGH VOLUME (compared to open interest) and b) High Implied Volatility

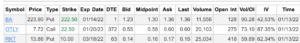

See examples of High Options Volume compared to open interest below

That’s what you need in the option.

High Implied Volatility means that the price fluctuates a lot – which increases the amount of UPSIDE, when writing calls (or puts). Low implied volatility means the stock price stays around the average more often.

Strategy – At Expiration, the market price can be one of 4 things.

Below your average price – No Loss. Profit = Premium

Above your Average price but Below the strike price – No Loss, Profit = Premium

Between the strike price + option premium price – No Loss. Even if exercised, we still made the option premium.

Above the strike price + option premium price –> Result- No Loss, but we just limited the amount of profit, by selling our underlying stock too early.

Summary – Regardless of the market price, you make your option premium.

The only ‘loss’ is the loss of additional profit, IF the price exceeds Strike Price + Premium Price

Leave a Reply